- Posted on

- Edin

Odluka o privremenim mjerama za oporavak od negativnih ekonomskih posljedica uzrokovanih virusnim oboljenjem „ COVID-19“ za klijente LOK mikrokreditne fondacije Sarajevo u Federaciji Bosne i Hercegovine. Odluka 130 03 22 Odluka Odluka 130 03 22 Odluka

- Posted on

- Lok-ured

Svim vjernicima katoličke vjeroispovijesti želimo sretan i čestit Božić VAŠA LOK MKF

- Posted on

- Lok-ured

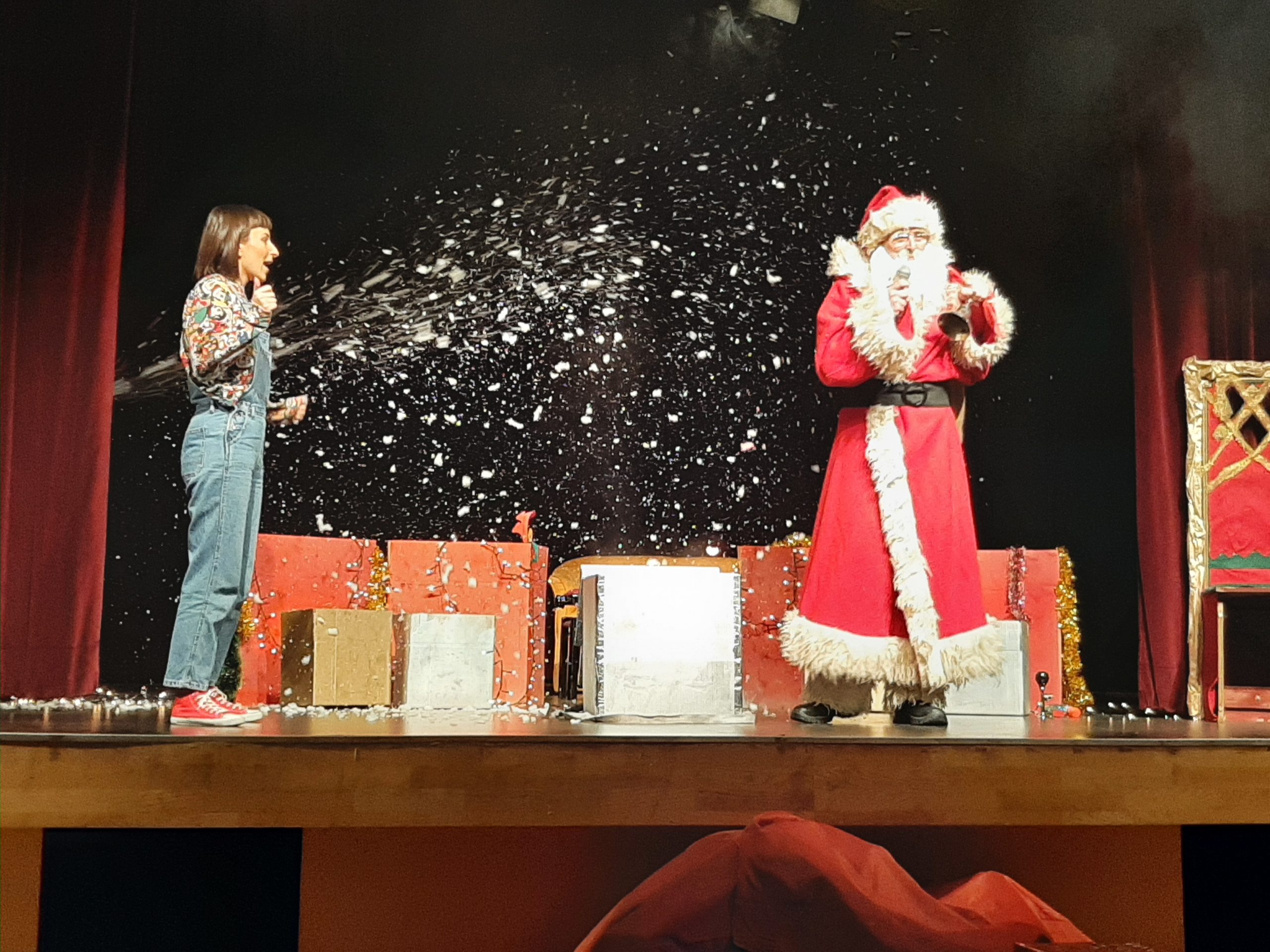

U duhu novogodišnjih praznika LOK MKF uručila je novogodišnje paketiće za djecu svojih uposlenika Bajkovita atmosfera teatra „Alteatar“ organizovala je veselo druženje sa Djeda Mrazom, koji je na radost naših najmlađih podijelio novogodišnje paketiće uz mnogo igre, plesa,zabave . Naši mališani su uživali u predstavi „Čarolija novogodišnje noći“, koja je izmamila osmijeh na dječijim licima. […]

- Posted on

- Lok-ured

Svim građanima Bosne i Hercegovine, najiskrenije čestitke povodom 25. novembra, Dana državnosti Bosne i Hercegovine Vaš LOK MKF

- Posted on

- Lok-ured

U okviru Panela 1 razgovarat ćemo o efektima mikrokreditiranja u svjetlu uticaja na razvoj poslova i unapređenje uslova života korisnika mikrokredita, sa osvrtom na načine prikupljanja relevantnih podataka i komunikaciju podataka sa javnošću Voditeljica Panela 1 je Elma Čardaklija Bašić, direktorica MKF Lok, a učesnici su mr. Ernadina Bajrović, viceguverner Centralne banke BiH, Vanja Cico, […]

- Posted on

- Lok-ured

Predstavnici mikrokreditne fondacije LOK uručili su vrijednu donaciju kancelarijskog namještaja J.P. Sarajevo. Ova donacija će olakšati svakodnevni rad ove ustanove. U okviru naše strategije društveno odgovornog poslovanja i poslodavca odlučili smo donirati namještaj J.P Sarajevo kako bismo olakšali svakodnevne poslove kojima se bave uposlenici ove ustanove. Ovim prijateljskim gestom nastojimo podržati rad J.P Sarajevo u […]

- Posted on

- Lok-ured

Dana 18.11.2021. godine Udruženje mikrokreditnih organizacija u Bosni I Hercegovini – AMFI, organizira konferenciju „Novo doba za mikrokreditni sektor u BiH sa početkom u 10h. Na konferenciji će biti riječi o nefinansijskim uslugama koje mikrokreditne organizacije pružaju u BiH, zatim razvoju malog poduzetništva, ulozi mikrokreditnih organizacija, digitalnoj transformaciji, zaštiti klijenata, socijalno odgovornom finansiranju i podizanju […]